Empowerment Infrastructure For Inclusive Finance

Rethinking Embedded Finance As An Everyday Infrastructure

-

Han Wen (Vanessa) Chang

Smrti Ganesan

Aabha A. Kale

Shirin Navgire -

Mariela Sotomayor

Juan Francisco Cabana

Tomas Nalda

Embedded finance integrates financial services through the many digital interfaces and platforms now mediating socioeconomic transactions. Evolving beyond traditional banking models, embedded lending, payment, and investment functionalities now propagate across e-commerce, transportation, property, and other everyday domains via application programming interfaces (APIs). This embedding facilitates increasingly ubiquitous, convenient financial flows through multiple touchpoints in daily life. On one hand, embedded finance shows the potential to lower barriers and democratize access. Yet the streak of disruption also gives regulatory infrastructures pause to ensure financial digitization does not outpace protection. Ultimately, the depth and diversity of embedded financial tools demonstrate finance dissolving into the very circulation of routine activities that enable life and livelihood. Embedded finance therefore transforms relationships between finance, technology, and society in complex ways and lies at the intersection, making it an evolving everyday infrastructure that governs the way we spend our resources.

What is Embedded Finance? How is it an Everyday Infrastructure?

Embedded finance refers to financial services and products that are integrated into non-financial contexts, environments and transactions, transforming them into an infrastructure enabling the routine functioning of daily economic life. Evolving from traditional banking models, embedded finance represents the proliferation of financial services across diverse interfaces ranging from shopping platforms to ridesharing apps. Financial functionalities become seamlessly interwoven into the user experiences of such digital technologies via application programming interfaces (APIs) and other tools for integration. This embedding thus helps facilitate financial flows related to online payments, lending, investments and more in increasingly seamless and frictionless ways across multiple touchpoints in consumers' lives.

Partners

Credicorp is the leading financial services holding company in Peru, with a presence in Colombia, Bolivia, Chile, Panama, and the United States. It currently has consolidated universal banking insurance and pension platforms that serve all segments of the Peruvian population, complemented by a significant presence in microfinance, investment banking, and wealth management in Latin America.

Yape is a payment platform leveraging financial transactions for both individuals and businesses. It is a solution to address the challenges of a straightforward, rapid, and secure method of monetory transactions. It uses the cell phone number in your contacts, or a QR code of Yape, Visa, or Izipay. It is the most used app in Peru. As of 2023, Yape has played a pivotal role in promoting financial inclusion by extending its services to over 2.5 million Peruvians.

How did finance get here?

Advent of Fintech

2008-2009

The 2008 financial crisis led to a decline in trust in large financial institutions and created an opportunity for fintech startups to offer alternative lending, payments, and investment services.

+ Alternative Lending

2010-2012

Fintech lenders like LendingClub and Prosper pioneered online marketplace lending platforms to compete with banks in areas like unsecured consumer loans, student loans, and small business loans.

Rise of Neobanks

mid 2010’s

New challenger "neobanks" like like Chime, N26, and Revolut emerged, offering mobile-first checking and savings accounts without physical branches that have modern tech stacks focus on user experience, and offer product intergrtions.

Lending Commoditised

-2022

Point of sale lending and "Buy Now, Pay Later" (BNPL) providers like Affirm, Afterpay, and Klarna emerged, letting consumers finance purchases in installments over time. This embeds lending commoditizes consumer credit for e-commerce.

Embedded & BaaS

-2022

The idea of "embedded finance" has taken off with fintech startups providing "Banking-as-a-Service" (BaaS) solutions that enable companies to embed financial services into their own platforms. Using data and APIs this movement is revolutionizing finance, data and value exchanges.

Problem Space Analysis

In urban landscapes, embedded finance has become a commonplace feature. The establishment of a financial service platform, much like a bike-sharing station, introduces not only a new urban element but also acts as a nucleus for daily transactions. This creates an infrastructure imbued with specific protocols and rules, shaped by the collaboration of various organizations.

The activation of networks within this financial hub facilitates seamless mobile communication between users and the embedded finance service. Electronic payments, predominantly through credit/ debit cards, become a routine part of transactions. Simultaneously, the platform engages in surveillance to analyze usage patterns and monitors personal financial data. As organizations introduce new transactions through integrated offerings, they inadvertently set parameters that determine access to these financial services.

The reliance on credit card payments creates a discriminatory system. While providing easy access for credit card holders, it marginalizes individuals with limited or no access to credit and financial services. The design of the financial infrastructure may favor adults, neglecting families with children. The autonomous integration of offerings within these distributed ownership networks tends to replicate and amplify existing biases, reinforcing privileges, and inadvertently discriminating against specific demographics. The consequence is an unintended limitation of access, exemplified by families with children facing barriers due to the absence of credit access for utilizing embedded financial services.

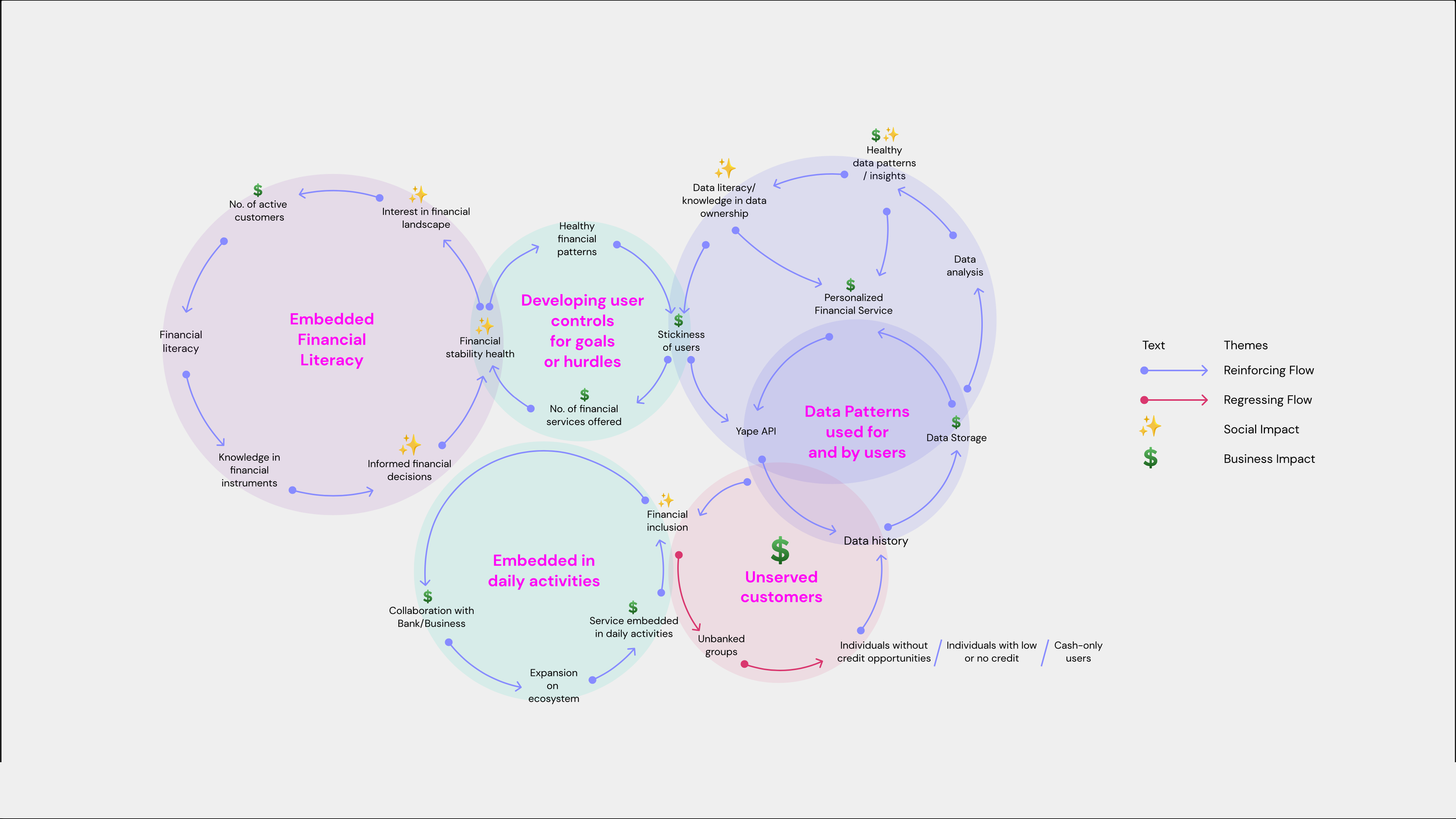

Current System Dynamics Map

Hotspots Identified

1.

Lower levels of Financial Literacy

Financial systems grapple with knowledge gaps, biases, and conditions like low financial literacy, particularly among low-income individuals. Actions such as adding features without proper public education contribute to these issues.

Asymmetries within the system:

Lack of knowledge of personal finance

Advisory Tools/Resources to develop/ inform healthy financial habits

Assumption of Financial Literacy

Biases within the system:

Financial systems are often opaque and complex.

Conditions within the system:

Lack of financial literacy among low-income.

Actions within the system:

Adding features without the proper education of the public.

2.

Data Transparency and Literacy

In embedded finance, there are asymmetries, with agencies holding control over data. Biases emerge toward profit-centric data collection. Conditions like privacy concerns hinder widespread adoption due to security apprehensions.

Asymmetries within the system:

Agency with abilities in control and ownership of data.

Biases within the system:

Bias toward Data Collection for profit.

Conditions within the system:

Data privacy and security actions can deter individuals from adopting embedded finance.

3.

Gender Inequality

In embedded finance, a gender gap persists, limiting financial access for women. System biases favor the mainstream user base, and conditions create hurdles for women and gender minorities to access credit. The system inadequately tailors products for diverse populations, perpetuating financial disparities.

Asymmetries within the system:

Prevalent gender gap due to the lack of access to financial services.

Biases within the system:

Bias towards mainstream user base

Conditions within the system:

Limited access to credit or financial services for women/gender minorities.

Actions within the system:

Failure to tailor products for diverse populations.

4.

Creditworthiness asymmetries

Embedded finance exhibits asymmetries in credit access and financial complexity. Biases favor the mainstream user base, excluding specific incomes or professions. Negative credit-building behaviors persist, and predatory alternative financial services thrive. The system fails to educate the public on credit, perpetuating disparities.

Asymmetries within the system:

Ability to build creditworthiness and get credit as the financial system is often opaque and complex.

Biases within the system:

Bias Toward Mainstream User Base.

Bias against Users with only particular incomes/professions.

Conditions within the system:

Bad credit-building behaviours.

Alternative financial services that are predatory.

Actions within the system:

Not helping the public understand the credit system.

Are we empowering every financial user?

Addressing Asymmetries, Biases, and Improving Conditions

Need for Intervention

1. Addressing Asymmetries:

Interventions are crucial to rectify information and power imbalances within the financial system, ensuring fair access and control over personal financial data.

“21% of Latin America still remains excluded, and the use of more advanced products like credit, investments, insurance, and e-commerce is still underpenetrated.”

2. Mitigating Biases:

Interventions should aim to reduce biases, making financial systems transparent, unbiased, and accessible to diverse user groups.

“Due to a lack of trust in technology, 25% of survey respondents would prefer to open a bank account in person as opposed to via mobile or using a computer.”

3. Improving Conditions:

Interventions must focus on enhancing financial literacy, especially among marginalized groups, to create a more inclusive and equitable financial landscape.

“According to a consumer survey, 84% of respondents believe that access to financial education helps or would help them improve their personal finances, but the majority of Latin Americans have not received any training, guidance, or assistance in the past (less than 50% in any market) on how to manage their money.”

4. Regulating Actions:

Interventions are needed to regulate the introduction of features and services, ensuring they align with ethical practices and user education.

“The gap in credit access creates a huge opportunity for innovation, and the industry—along with regulators—must be vigilant about consumer credit protections so that what is being offered is sustainable and leads to financial well-being.”

Awareness and Advocacy:

Leaders and influencers driving awareness for equitable finance.

“According to the survey by WallStreetZen, 76% of Gen Z admit to turning to platforms like TikTok, YouTube, and Reddit for financial education.”

“For example, in Brazil, neobank N26 is establishing the notion of fincare, the idea that financial service providers should help customers understand how to get more value out of their financial products.”

Drivers for Change

Policy and Regulation:

Governments enact policies to foster fairness, security, and accessibility.

Latin Americans’ relationship with money and finance has dramatically changed since COVID-19, and the primary shifts were their adoption of mobile financial services and their reduction of cash use. This has been achieved via the government paying assistance benefits digitally, the improvement in the user experience of digital financial services, and the implementation of interoperable payment schemes that have made digital payments, especially P2P, easier, faster, cheaper, and more accessible.

1.

Embedded Finance & Financial Inclusion

By providing equal access to financial services for all segments of the population.

Goals

2.

Increase Financial Agency

By equipping people with financial literacy - the education, knowledge, skills and awareness to manage money flows and make sound personal finance decisions that enable shaping one’s economic future.

3.

Support Financial Empowerment

By giving customers more control over their financial lives through ongoing financial education, personalized products designed to adapt to emerging user needs, and data insights that expand opportunities for financial agency.

Macro Level

Opportunity Areas

Embedded Financial Literacy

Integrate personalized financial training, insights, and two-way support directly into account services and transaction flows.

Data patterns used for and by users

Provide people more control over shared data, insights into implications, and guidance to make informed consent choices that protect their interests.

Developing user controls for goals or hurdles

Meet users where they are across life stages and needs with tools and recommendations tailored to their individual situations for sustained daily empowerment via financial mentors accessible on the same platform.

Proposed Archetype

User needs focused

Current Capabilities

User research-driven

Co-designed solutions

User-type focused solutions

Embedded in daily lives

Intuitive tools

Responsible nudges

Automated actions

Seamless integration

Partnerships for products

Spending insights

Cash flow visibility

Cross-pollinated Data

Data from all stakeholders

Alternative scoring

Open infrastructure

Security & Protection

Financial Knowledge

Proposed New Capabilities

Tailored contextual knowledge building

Building confidence through trial tools

Foster positive behavior change

Transparency

Better insights based on personal patterns

Building confidence through trial tools

Ownership and access to data usage

User Controls

Fair eligibility

Access to trial tools to build confidence

Enable financial empowerment

How might we align these opportunity spaces with goals?

Developing possible strategies and tools to address these goals.

By gamifying financial literacy within the app, Yape can equip teens to make wiser money choices as young adult consumers. Partnering with schools turns key topics like budgeting and investing into entertaining and achievable challenges to develop a future where financial acumen is the norm.

Gamified Literacy Tools for Youth

Digital Identity as Financial Passport

Yape can empower the underbanked to self-report and track their financial data into a secure digital identity - a dynamic passport revealing financial credibility over time. With user controls it could be an open platform that enables permissioned data sharing to sustainably graduate financial access. This digital portal represents a powerful option for converting unbanked to digital opportunities.

Yape allows self-customized financial bundles syncing investing, insurance and credit services, lifestyle needs, and advisory into existing digital routines like bill pay and expense tracking - simplifying money management through an intuitive subscription model enhancing modern lifestyles.

Personalized Subscription Bundles

Features

Interactive Budgeting Simulators

Allow consumers to model different budgeting strategies through engaging “sandbox” interfaces reflecting their real finances. Build financial judgment.

Interactive

Planners

Interactive analyzers and planners with personalized budgets, benchmarking habits against peers, and adjusting goals through a platform that analyzes outflows and inflows to improve & motivate money management.

Personalized

Options

Offer self-customized bundled digital financial service packages - payment plans, credit, insurance, investing tools, etc. Simplify through one subscription model adaptable to consumer life stages.

Embedded Savings Nudges

The app uses behavioral prompts to encourage regular incremental transfers to savings accounts or investment vehicles aligned with the user's cash flow patterns and goals. Develops saving habits.

Cash Flow

Calendars

Users directly manipulate future income/expenses in a calendar view to visualize and optimize cash flow around goals. Builds financial planning skills.

Data usage and sharing controls

Users decide which pieces of financial data & profiles and connect other instrument data for visibility to maintain privacy comfort levels while still enabling personalized services with informed consent.